In a world where business cycles tighten, capital becomes selective, and hybrid work reshapes team behavior, Vietnam’s office market is entering a transformative phase. For CEOs, Country Managers, and business leaders planning ahead for 2025–2026, understanding these shifts is not merely useful – it is strategic.

The modern workplace has evolved from a cost center into a strategic lever: one that signals culture, attracts talent, enhances productivity, and strengthens brand presence. Today’s data shows that Vietnam’s two major hubs – Ho Chi Minh City and Hanoi – are moving along different trajectories, each presenting unique opportunities.

The Ho Chi Minh City and Hanoi markets are telling two different stories, leading to different strategic imperatives.

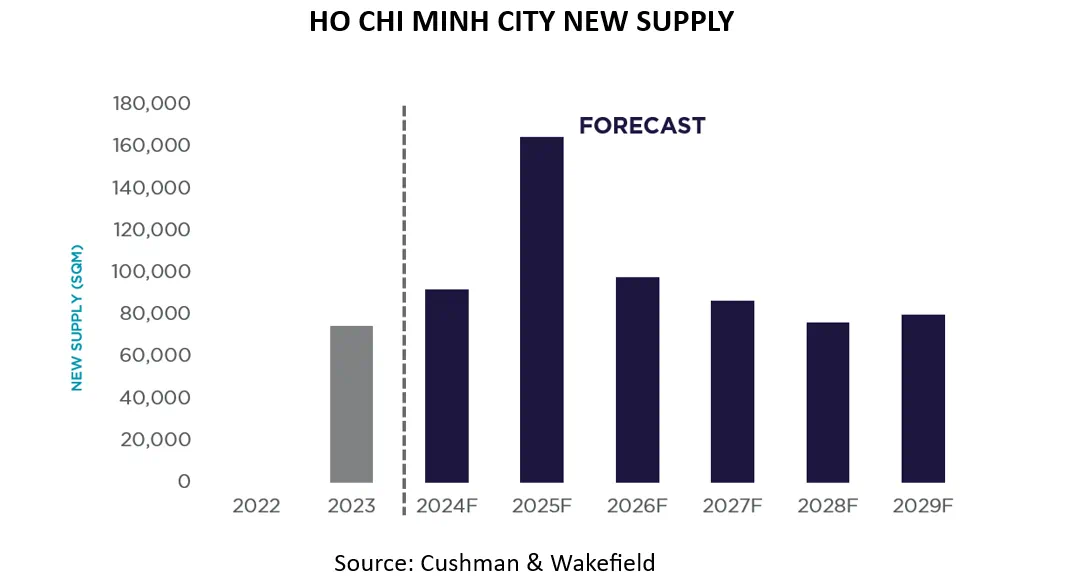

The HCMC market is facing a significant influx of new supply, projected to continue from 2025 through 2029. According to Savills’ Q3 2025 data, this high supply is expected to keep vacancy rates elevated. Grade A vacancy reached ~20–22% in 2024 (CBRE), with vacancy expected to remain elevated until 2027 as a new wave of supply enters the market.

What this means is:

For leaders balancing cost discipline with the need for an inspiring workplace, this is a rare window of opportunity. In a flat or tenant-friendly market, “locking in” a 5-year, high-priced traditional lease (a massive CAPEX commitment) is a significant financial risk. The smartest cost optimization strategy is to avoid CAPEX entirely, maintain flexibility, and leverage a flexible OPEX office solution that can adapt to market conditions.

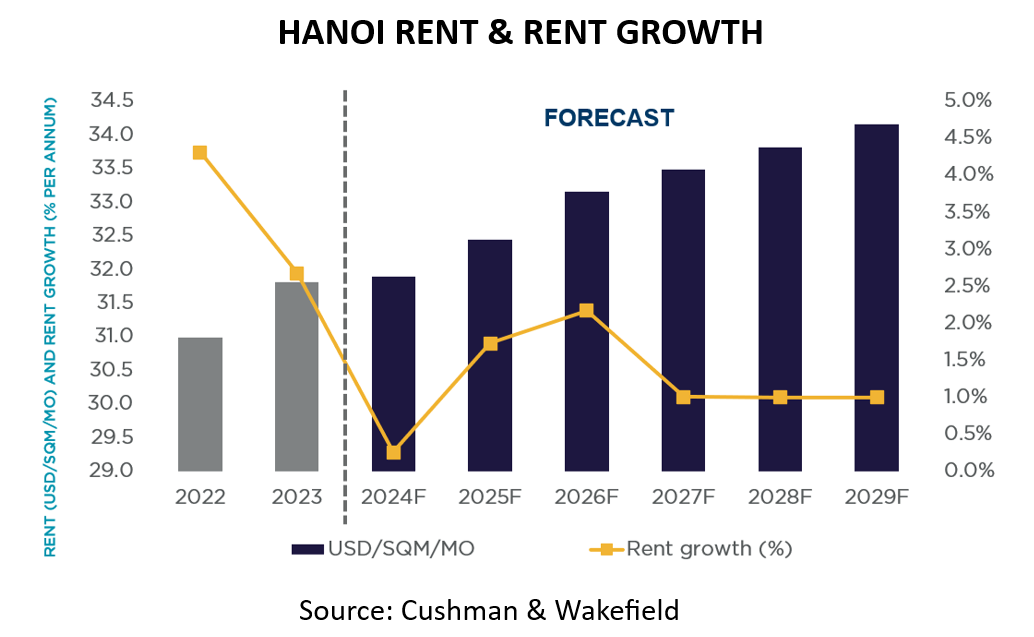

In contrast, CBRE’s Q3 2025 report shows the Hanoi market is absorbing new supply very effectively. Demand for high-quality, Grade A space remains robust, keeping occupancy rates stable at over 85%.

The market is characterized by:

High demand means premium, well-located spaces are competitive. The advantage goes to the company that can move fastest. A traditional office strategy that requires 6-9 months for search, design, and fit-out is a strategic liability, as you will lose the best locations. A flexible, move-in-ready solution allows you to secure a prime address in days, not quarters.

If you have difficulty choosing, check our guides to the best serviced offices, WeWork or Dreamplex, and Toong or Dreamplex.

Beyond rental cycles and vacancy rates, three structural trends are reshaping workplace strategy.

ESG (Environmental, Social, Governance) is no longer a “nice-to-have” bullet point. Flexible, green-certified workspaces are no longer a premium add-on — they are becoming the baseline expectation.

A 2025 JLL survey revealed that 78% of multinational tenants in Vietnam now list green certification (LEED, Green Mark) as a “mandatory” or “highly important” factor in lease renewals, driven by their need to comply with global corporate sustainability commitments.

Deloitte’s 2025 GenZ & Millennial survey finds that 71% of young professionals say workplace design significantly impacts their motivation. PwC’s Future of Work Asia report shows human-centric spaces can increase satisfaction by up to 40%. Leaders must prioritize:

This is no longer aesthetics — it is strategy. Gartner’s survey showed that organizations with the most human-centric work environments are 3.8 times more likely to see high employee performance, 3.2 times more likely to enjoy high intent to stay among employees and 3.1 times more likely to see low levels of fatigue among employees than those organizations with far fewer human-centric attributes.

The hybrid work model has permanently changed the purpose of the office. It is no longer a “factory” for 8-hour solo work. It is a “hub” for collaboration, culture, and innovation, which employees choose to visit.

This new purpose demands a new kind of space—what we call “Coworking 2.0” or the true flexible office:

JLL’s 2025 Flexible Space Outlook predicts flexible workspace penetration in APAC will rise from 3.5% to 5–6% by 2027, driven by hybrid adoption. Vietnam is seeing 12% YoY growth in service-integrated coworking models (CBRE). Coworking 2.0 has arrived: hospitality-first, experience-heavy, cost-transparent.

The 2026 market data and strategic trends reveal a clear truth: The traditional, 5-year CAPEX lease is now a financial liability and a strategic handicap.

The optimal office strategy for 2026 is a flexible, OPEX-based office solution that allows you to:

HCMC is offering unprecedented variety and negotiating power. Hanoi provides stability and steady absorption. Hybrid is changing the physics of office design. ESG is reshaping expectations from the inside out.

For CEOs thinking about the next chapter of their business in Vietnam, this is the moment to rethink how your workplace can help your teams thrive.

Dreamplex creates “A Better Day at Work” by perfectly meeting the needs of rapidly growing companies that understand their young employees expect more from their workplace.

With professional, flexible workspaces, top-notch hospitality services, and a collaborative community for mutual growth, Dreamplex helps businesses work productively while optimizing operational costs.

Join the community with tech experts and startup founders from TIKI, Zuhlke Vietnam, GFT Group, Vietcetera, at Dreamplex’s flexible office spaces in Ho Chi Minh City and Hanoi.

Get a quote and explore this month special promotions at:

WE CREATE BETTER DAYS AT WORK.